By Chelsea Spivey

Senior Director, New Business Development & Production Incentives • Revolution Entertainment Services

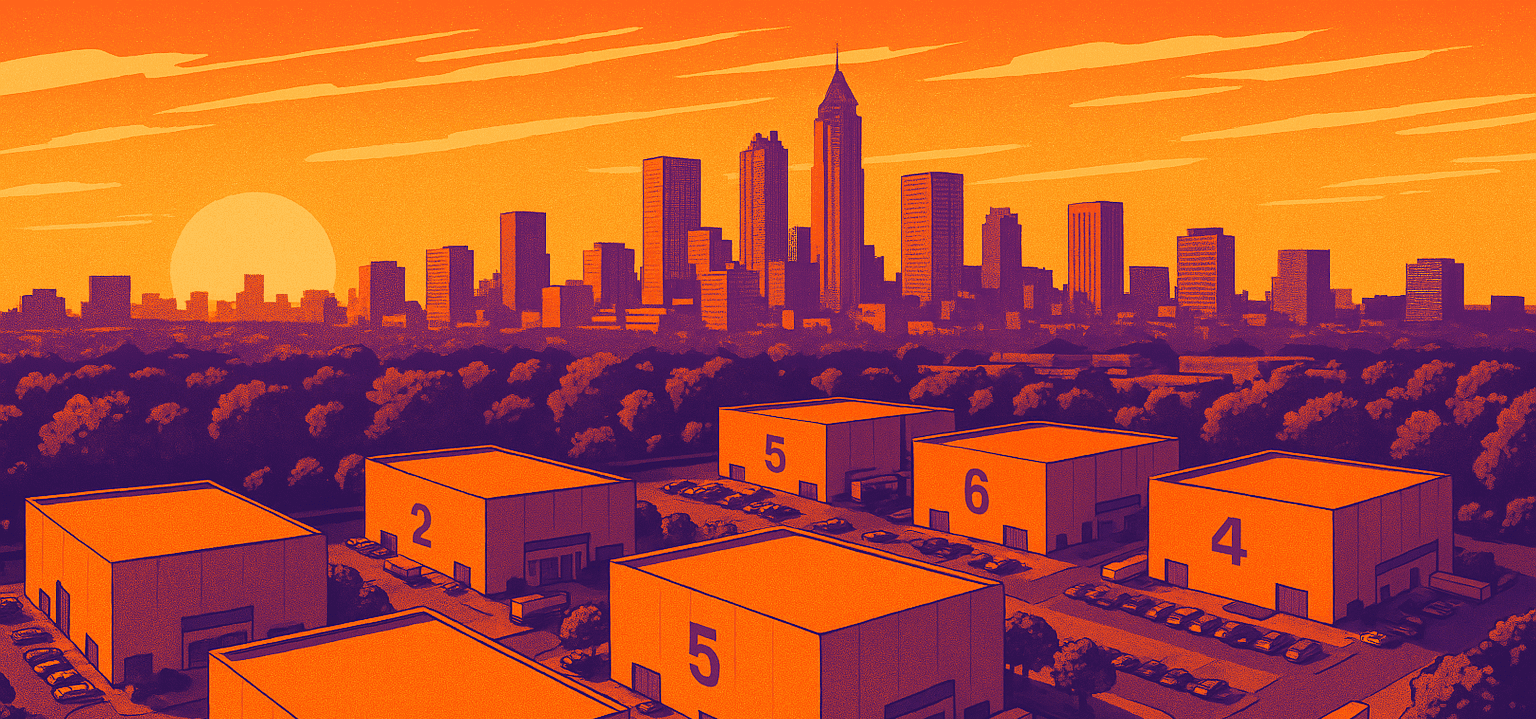

As someone who works closely with producers, studio executives, accountants, and creatives navigating film incentives across the country, I can say this with confidence: Georgia’s recent changes to its film tax credit audit process are not just welcomed—they’re a game changer. And they couldn’t have come at a more critical time.

The Georgia Department of Revenue’s (DOR) newly implemented audit procedures—crafted in collaboration with industry stakeholders—finally address a long-standing inefficiency by eliminating a one-size-fits-all approach to audits. Previously, a $500,000 indie film was subjected to the same requirements as a $130 million tentpole production. The recent changes now scale the audit based on the size of a project’s expenditures, reducing sample sizes and providing more reasonable error projections. That’s meaningful progress for productions of every size, especially smaller or independent projects that form the bedrock of Georgia’s industry ecosystem.

I’ve already seen the impact firsthand. Two features we’re supporting were weighing whether to shoot in Georgia or take their budgets elsewhere. The clarity and fairness of these new procedures sealed the deal—they’re staying here. That’s revenue, jobs, and opportunity Georgia just retained because it chose to listen.

In addition to audit reforms, changes such as raising the threshold for fixed asset reporting and consolidating airfare and lodging categories are streamlining compliance. That means less red tape, faster credit monetization, and more time and money focused where it belongs—on production.

But Georgia isn’t stopping there. With HB 129 and HB 475 both heading to the Governor’s desk for signature to become law, the state is doubling down on its long-term commitment to this industry.

HB 129 revives Georgia’s post-production incentive program, which had expired in 2022. From 2026 to 2031, up to $10 million annually will be available to support post-production work conducted in Georgia—building on the incentive for Georgia-lensed productions, which already includes post work as a qualifying expense under the base 20% tax credit (with no cap or sunset). And here’s the best part: if the full $10 million isn’t used in a given year, the unused funds will roll forward, expanding the opportunity the following year. That’s smart, sustainable growth—and it directly supports Georgia’s burgeoning post ecosystem, which is too often overlooked in favor of on-set work.

HB 475 brings long-overdue modernization to the language in Georgia’s 20-year-old film tax credit statute. These administrative updates may not grab headlines, but they’re vital. They ensure the state can continue to administer the program effectively and fairly, reflecting the realities of today’s production environment. This is about securing the credit’s long-term stability while enhancing accountability—a win-win for the industry and taxpayers alike.

Together, these reforms and legislative efforts send a powerful signal: Georgia is not only open for business, it’s actively working to improve how it does business with the film and television production industry.

In a global content marketplace where incentives in places like the UK, Canada, and Australia are fiercely competitive, Georgia’s willingness to adapt is critical. These latest changes—born out of collaboration, transparency, and responsiveness—are exactly the kind of policy signals that keep productions returning year after year.

As someone who regularly helps productions choose where to land, I can tell you that trust matters. Clarity matters. Consistency matters. Georgia’s leadership is showing the industry that it understands this—and that’s why producers, studios, and creatives are paying attention.

This is how Georgia stays competitive. This is how Georgia grows. And most importantly, this is how Georgia remains a top-tier destination for production for years to come.

For more information, feel free to email Chelsea Spivey at: cspivey@revolutiones.com