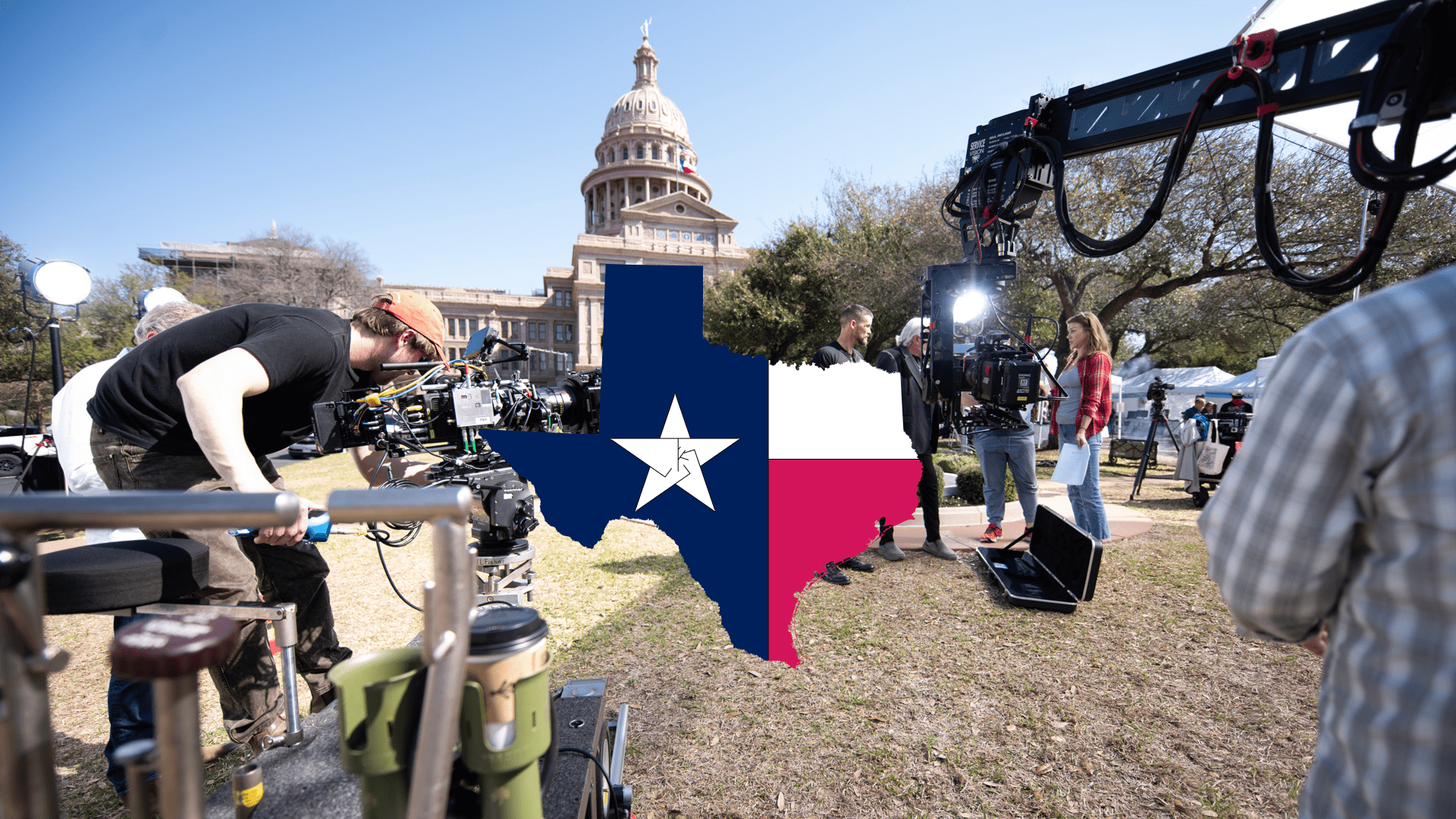

The film and television industry in Greater Los Angeles is facing significant shifts, as highlighted by FilmLA’s latest Scripted Content Study. Production in L.A. has fallen nearly 20%, driven by dual labor strikes and broader changes in the entertainment landscape. As FilmLA’s report notes, 2023 saw a 19.7% decline, with only 183 projects compared to 228 in 2022.

This drop in production is not just a local issue. Competition from global hubs like the UK, Georgia, and Ontario is intensifying. These regions, bolstered by attractive tax incentives and robust infrastructure, are becoming serious threats to Los Angeles’ dominance in the industry. California’s market share, which accounted for 22% of qualified projects in 2022, slid to just 18% in 2023, a worrying trend for one of the world’s largest production hubs.

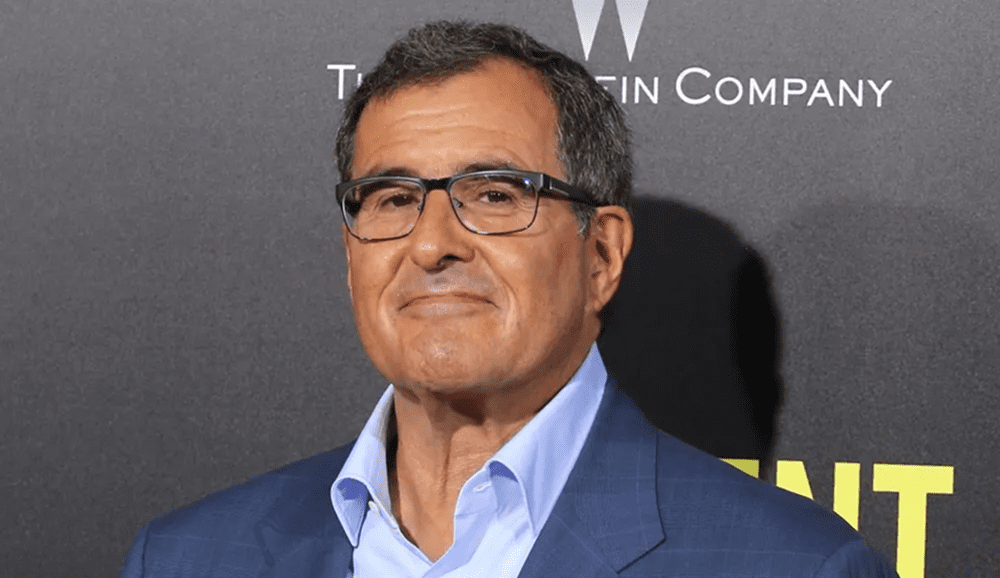

The strikes in 2023, coupled with cost-cutting from major media companies and a shift by streaming platforms, have significantly impacted the industry. FilmLA President Paul Audley warned of the economic implications, pointing out that the entertainment industry feeds around $43 billion into the state’s economy annually. The downturn is threatening the livelihoods of local businesses that depend on the industry’s success.

According to Audley, California’s tax incentive program is not keeping up with global competitors, calling for a “vast expansion” of the program to retain and attract more productions. While Governor Gavin Newsom has resisted calls to enhance the tax incentives, Audley and others argue that failing to do so puts California’s economy at risk.

In contrast, regions like the UK, Georgia, and Ontario are using competitive tax incentives to lure production away from L.A. For instance, the UK offers a 25% tax relief program, Ontario provides a 21.5% labor tax credit, and Georgia boasts a 20-30% credit on production costs. These programs have enabled them to secure an increasing share of U.S. productions, further eroding L.A.’s status as the go-to production hub.

The situation is not limited to large-scale productions. As Lindsey P. Horvath, Chair of the Los Angeles County Board of Supervisors, noted, the crisis has deeply affected industry workers, from grips to caterers. In response, the County has launched an Entertainment Business Interruption Fund to support these workers while exploring additional local incentives to sustain production.

Los Angeles’ infrastructure, with over 5.7 million square feet of soundstage space, remains a key asset. But as the FilmLA report suggests, that alone may not be enough to maintain its competitive edge without stronger financial incentives to match the global competition.

As more jurisdictions ramp up their incentives and expand their production infrastructure, Los Angeles must act decisively to sustain its position in the global production landscape. Without swift changes to its tax incentives, the “entertainment capital of the world” could face further declines, putting the entire ecosystem at risk.

To download the FilmLA Report click HERE