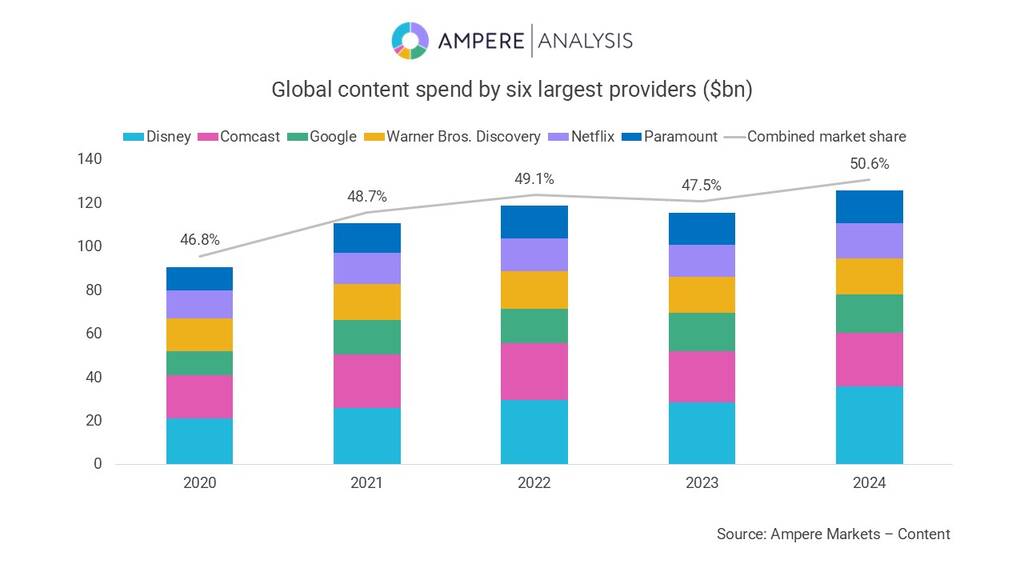

As the production landscape faces market headwinds, the biggest names in entertainment—Disney, Comcast, Google, Warner Bros. Discovery, Netflix, and Paramount—are doubling down, collectively investing $126 billion in content in 2024. Ampere Analysis reports that these six giants now control over half (51%) of global content spending, a significant rise from their 47% share just four years ago.

Key Takeaways from Ampere Analysis:

-

Disney Leads the Pack Despite shifting strategies across its linear and theatrical brands, Disney continues to be the top content investor, accounting for a hefty 14% of global media spending. This growth follows Disney’s complete acquisition of Hulu earlier this year, which contributed an additional $9 billion to its content budget.

-

Original Content Drives Growth For the big six, original programming is paramount, accounting for over $56 billion—or 45%—of their total content spend since 2022. From high-budget series to innovative feature films, original content is fueling both subscriber growth and audience retention.

-

YouTube on the Rise Google, through YouTube, ranks as the third largest content spender. YouTube’s unique approach—revenue-sharing with creators and forging partnerships with global content players—differentiates it from traditional studios. This model has helped YouTube build a worldwide footprint, further solidifying its position in the content landscape.

-

Netflix’s Steady Climb With an annual average spend of $14.5 billion on original and acquired programming since the pandemic, Netflix remains the largest global investor in streaming content. Its commitment is set to expand in 2025 as it ventures into live sports, including NFL matches and WWE events, broadening its appeal and positioning in the entertainment ecosystem.

-

Streaming Dominates Content Spend Of the $126 billion invested, $40 billion goes into streaming services like Disney+, Peacock, and Paramount+, underscoring the shift from traditional TV toward streaming. These platforms’ expansive catalogs and ease of access are becoming increasingly attractive as audiences continue to cut the cord.

-

The Global Shift In response to production shutdowns due to the recent US writers’ and actors’ strikes, streamers have diversified with more international content. This year, international programming made up 40% of Paramount+’s spend and 52% of Netflix’s. Global content not only reduces costs but also drives growth by reaching new audiences in emerging markets.

These six powerhouses continue to reshape the content landscape, backing global strategies and fueling the industry’s future amid shifting viewer habits and expanding media platforms.