Film tax incentives may be coming back to Michigan. A group of state lawmakers have introduced the Multimedia Jobs Act, which would bring back Michigan’s pre-crash film tax incentives. This sudden reverse-course highlights how the entertainment industry is rapidly expanding outside of its traditional hubs of New York and Los Angeles.

Michigan previously offered rebates for filmmakers who brought their productions to the state. At the time, the film incentive program was “one of the most aggressive in the country” and gave significant rebates to film productions. Several blockbusters were filmed in Michigan including Clint Eastwood’s Grand Torino (2008), Thirty Minutes or Less (2010), Transformers: Age of Extinction (2014), and Batman vs Superman (2016). The original Michigan tax credit was incredibly generous, providing cash rebates to filmmakers up to 42 percent of total production costs. Unsurprisingly, in 2015, the original tax-incentive program was shut down by then-Governor Rick Snyder over concerns that the return on generous investment to Michigan taxpayers was negligible.

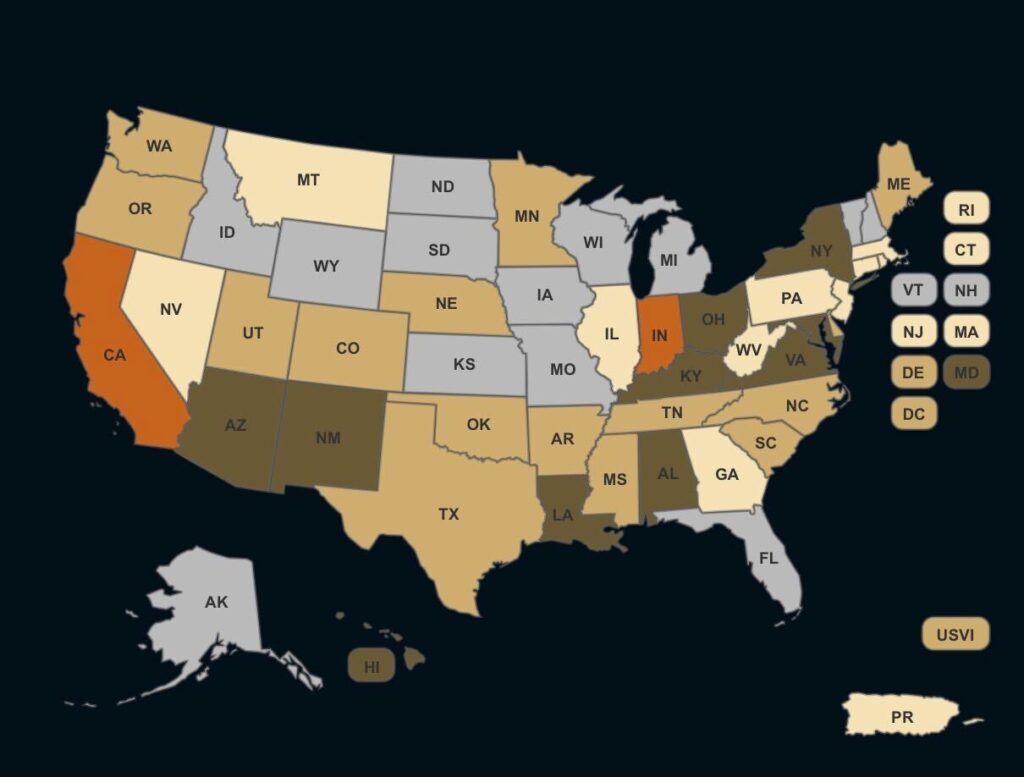

In the time since Michigan abandoned its film incentive program, 35 states have begun their own tax incentive programs. These incentives, which have exploded in popularity over the last decade, are geared towards encouraging filmmakers to film commercial, television, and/or films in that state. Michigan is one of only fifteen states not to have any form of tax incentive program, with most states offering a tax credit between 10 and 20 percent, with some states going as high as 35 percent.