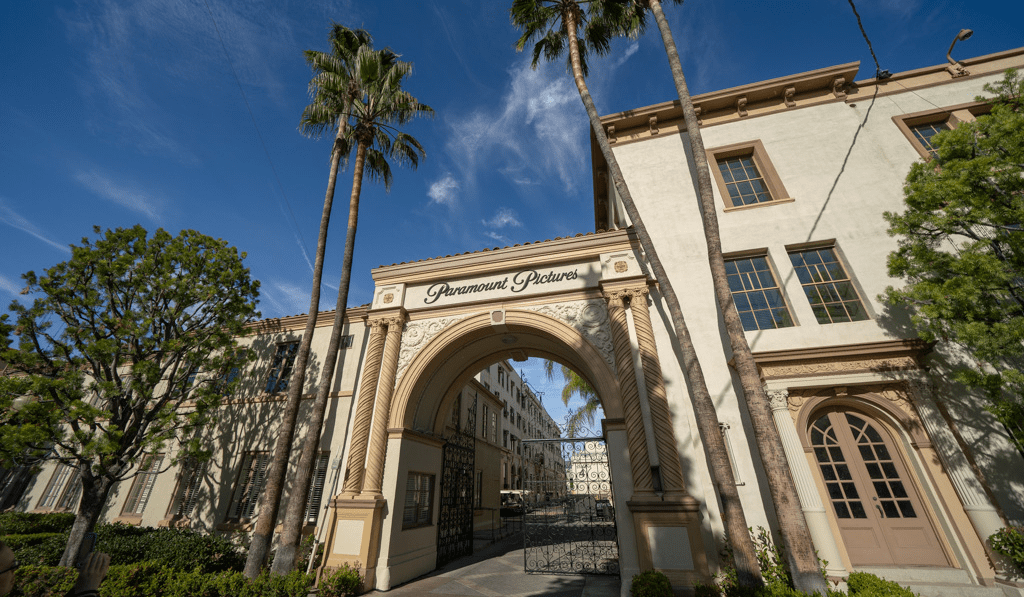

As labor strikes by actors and screenwriters push back release dates for new movies and TV shows, production companies are continuing to move ahead with major new film studios in the east — but in New York, New Jersey and Georgia, with Connecticut still just a small backlot for the industry despite tax incentives on par with the states that are drawing the marquee studios of Hollywood.

Connecticut does not make an appearance on an updated August roster of major new U.S. studios under construction or otherwise in the offing, published by The Studio Map which tracks industry developments. New Jersey has three big studios in the works: the massive Netflix production campus planned for Fort Monmouth, a Lionsgate studio in Newark, and the 1888 Studios lot proposed for a 75-acre waterfront tract in Bayonne.

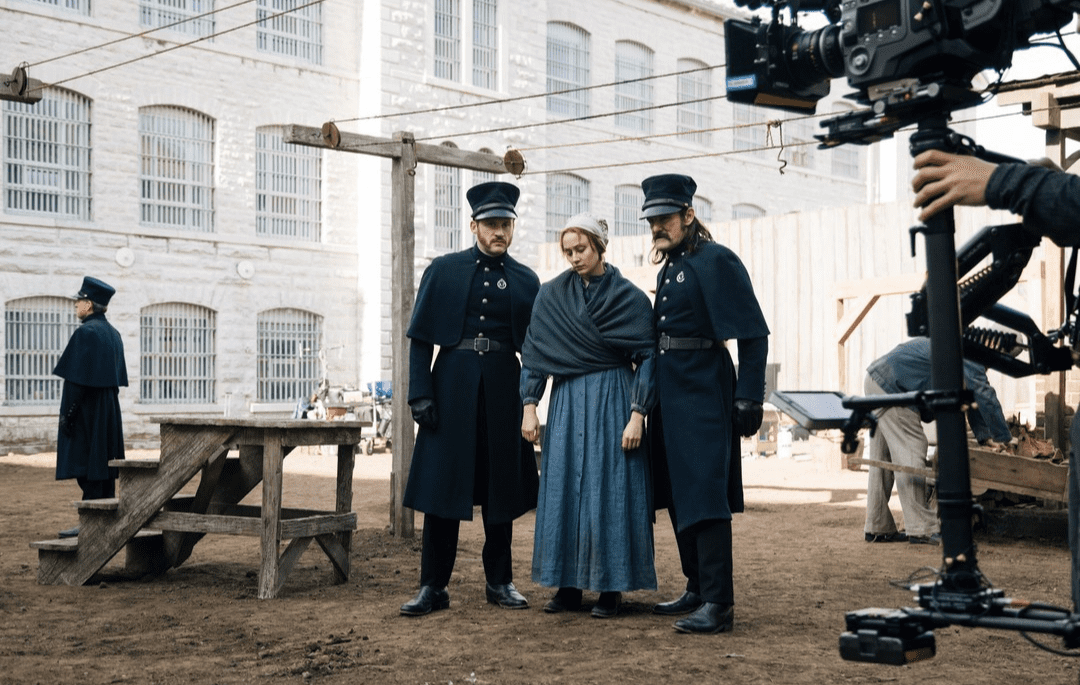

For now, most film and TV work is on pause in the tri-state region, as actors and writers hold out for better pay and residual compensation as productions get longer shelf lives in the streaming era.

“The strike is of course having an impact here as well,” stated George Norfleet, director of the Connecticut Office of Film, TV & Digital Media, in an email response to a CT Insider query. “The unions that are on strike are organized as a tri-state local.”

That aside, Norfleet offered no insights as to why Connecticut has been shut out of a succession of major studio expansions and startups. In addition to the New Jersey and New York projects, four big developments are under way in Georgia, including one being built in phases with NBCUniversal already settling in to produce some of its programming.

Industry analysts routinely lump Georgia in with Connecticut among the handful of states nationally offering the most-generous incentives in the country, with state lawmakers having yet to implement a cap on tax incentives that totaled $1.3 billion last year. By comparison, New York has a $700 million cap on tax incentives, with California’s cap currently set at $330 million.

The Georgia Department of Audits and Accounts has faulted that state’s tax credit for being structured in a way that allowed more than half of industry wages to be paid to people who live in other states.

Between 2015 and 2020, New York City’s film and TV industry increased employment there by 17 percent to nearly 80,000 people, according to data cited by Deloitte auditors, even as screen jobs in California dropped 4 percent.

It was Connecticut that was building industry star power more than a decade ago, as it drew Blue Sky Studios and NBC Sports in quick succession across the New York border, which with ESPN’s and WWE’s existing operations put the state on the industry map. And Stamford became a minor tourist destination after NBCUniversal took over the downtown Rich Forum Theatre for daytime talk show tapings, including “The Jerry Springer Show” and “Maury.”.

Since then, Connecticut has seen proposals for new screen production campuses, but none with the financial backing of the most powerful producers in Hollywood. Connecticut Studios and Hollywood East fell by the wayside in South Windsor and Stratford, respectively, while Jaigantic Studios has yet to move ahead with a large facility teased for New Haven by actor and producer Michael Jai White.

That has occurred as other locales have seen studios emerge from marquee names in their midst — Robert De Niro and Tyler Perry have large new studio expansions in the works for Manhattan and Atlanta respectively — and as the overall industry has mushroomed in the streaming era.

The new studios are just the latest in an ongoing industry expansion. Over five years through 2022, California, New York and Georgia each saw the addition of a million square feet of production space, according to surveys by Film LA, a location shot consultancy. Ontario’s industry swelled by 1.5 million square feet and the United Kingdom’s by close to two million.

One hurdle for Connecticut are circles drawn by screen guilds anywhere from 25 miles to 30 miles from Columbus Circle in Manhattan, beyond which member workers get paid extra to cover commutes. The outermost radius crosses through Stamford just west of the downtown stop of Metro-North, leaving a number of industrial properties to the north and east outside the loop that could be candidates for production lots. By contrast, California allows productions to apply for a 5 percent tax credit to cover higher costs for projects outside the core Los Angeles area.

Inside New York’s beltway is the newest big production studio in the Northeast — Lionsgate Studios in Yonkers, whose developer Great Point Studios bills it as the “Burbank” of New York with more than a million square feet of sound stages and production space, on par with Steiner Studios in New York City. For a follow-on Lionsgate studio that will total 300,000 square feet, Great Point Studios chose property close to Newark Liberty International Airport in New Jersey.

In signing off on the tax credit program in 2006, the Connecticut General Assembly and former Gov. Jodi M. Rell were counting on a growing base of industry stalwarts to draw more than its neighboring states. But that did not occur, save for isolated examples like the small CBS Sports HQ studio that opened in 2018, or Skydance Studio which has hired animators in Greenwich who worked previously for the shuttered Blue Sky Studios owned briefly by Walt Disney Co.

Comcast, which owns NBCUniversal and NBC Sports, is leasing the Assembly Studios production lot being built in phases at a former automotive factory in Atlanta, which will have nearly 20 sound stages and exterior settings and building facades for outdoor shots. Developer Gray Television anticipates a workforce of some 1,200 people at Assembly Studios, both with NBCUniversal and other companies, and plans to lease out the production facilities.

“Literally a couple of days ago, there were dozens of 18-wheeler trucks that were arriving here from all over the country, bringing in lights, cameras, growth stuff and everything else,” Gray Television CEO Hilton Howell said in early August, speaking on a conference call with investment analysts.

Includes prior reporting by Andrew DaRosa, Paul Schott and Luther Turmelle who contributed to this report.

Article Originated at: CT Insider

https://www.ctinsider.com/business/article/ct-ny-nj-film-tv-tax-credit-ga-18334056.php