Jan. 24—New Mexico film — it works.

This is the message an economic impact study by the New Mexico Film Office confirms.

The study found that the New Mexico Film Production Tax Credit produced an average economic return on investment (ROI) of $7.77 for the state from fiscal year 2020 to fiscal year 2023.

Which means that for every dollar invested in the tax credit, the state received $7.77 in economic benefit.

The New Mexico Film Office (NMFO) released the study on Dec. 28. It comes a few months after the Legislative Finance Committee released its own study that found that the film tax credits are less effective at attracting private investment, cost more per job and have a lower return on investment than other incentive programs.

Amber Dodson, New Mexico Film Office director, said the study was compiled by the department’s in-house economist, Shane Shariff.

“When I first arrived at the film office, it was certain there needed to be an economist on staff,” Dodson said. “With the magnitude of the state’s film tax incentive, it makes sense to have it in house and not have to pay a third party to compile the data and create the reports. Everything that we do in the film office, I want it to be transparent. I feel like that position can never be lost.”

The NMFO study found that the state tax credit generated an estimated $3.8 billion in total economic output in New Mexico from fiscal year 2020 to fiscal year 2023.

Total economic output includes direct, indirect and induced impacts, which account for such things as uplift activity in the supply chain and induced effects from production wages.

With its amendment during the 2023 legislative session, the rural uplift credit — which gives a production an extra 10% in rebates for filming at least 60 miles outside the Albuquerque-Santa Fe corridor — provides between 25-40% reimbursement for eligible spending by film production companies.

During each legislative session, there have been bills to help streamline the tax incentive program.

Per statute, the program is designed to establish the film industry as a permanent component of the state’s economic base, create jobs, improve economic success and create infrastructure for the film industry.

Film companies apply for the tax credit with the New Mexico Taxation and Revenue Department and receive reimbursement for the eligible spending.

Dodson said another bright spot is that the film industry creates high-paying jobs.

According to the report, the tax credit supported approximately 8,000 full-time equivalent jobs in the state.

In fiscal year 2023, the median hourly wage for full-time New Mexico crew members was $35.51 per hour, whereas the median wage in New Mexico for all industries was $19.19 per hour, and the state minimum wage as of 2022 is $12 per hour.

The study also found that the tax credit positively impacts rural communities in the state. Rural production spending increased from $4.5 million in fiscal year 2020 to $6.5 million in fiscal year 2021, reached a new record of $49.5 million in fiscal 2022, and even hit $21.2 million amidst industry strikes in fiscal 2023.

“The study provides clear evidence that the New Mexico Film Production Tax Credit is a valuable investment for our state,” Dodson said. “The tax credit generates significant economic benefits. It supports 8,000 jobs, high wages, and expansive investment in our businesses and communities.”

According to the LFC report, in fiscal year 2022, film incentives were nearly 10 times larger than the next biggest economic development tax incentives, and film incentives were twice as large as all other economic development tax incentives combined.

The report also said that in the next five years, tax expenditures through the Film Production Tax Credit could grow by 171%, increasing from $100.2 million in fiscal year 2023 to $272.1 million by fiscal year 2028.

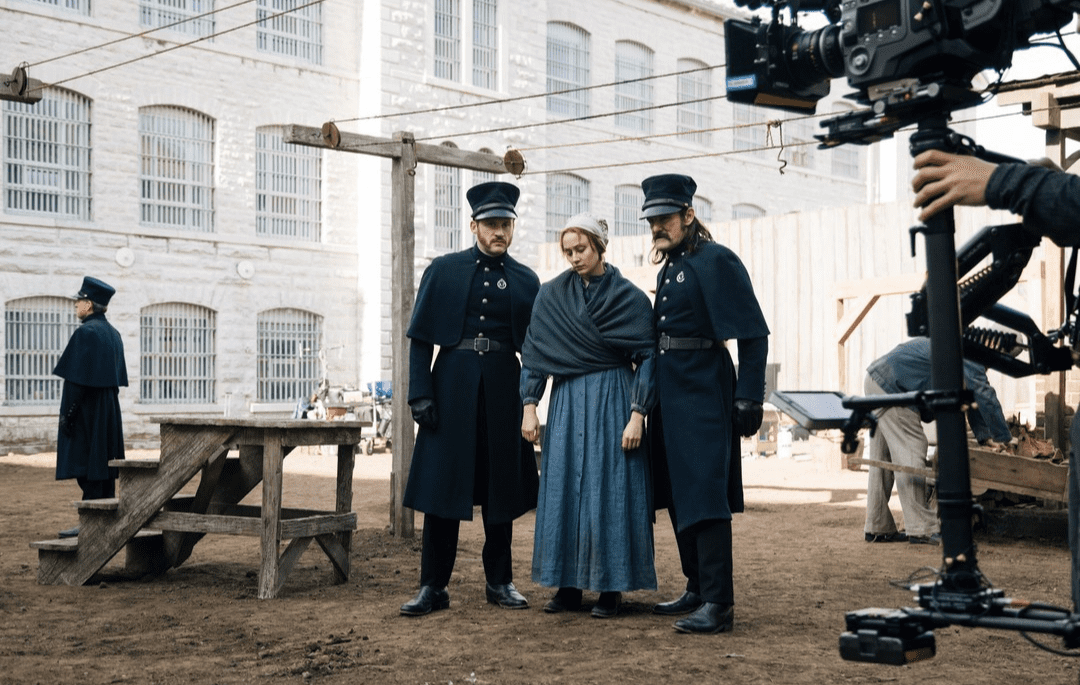

There are three New Mexico film partners — Netflix Studios, NBC Universal and 828 Productions — that have made at least a 10-year deal to have a production hub in New Mexico.

Dodson said the film partners help create sustainability and each offers training opportunities for New Mexicans.

The state continues to offer a competitive tax credit program, oversee and support workforce development and training programs for New Mexicans, and promote the state as a premier destination for film and television production.

“We’ve successfully worked with the New Mexico Film Office and Netflix to create two cohorts for production accounting workshops,” said Mark Duran, Central New Mexico Community College senior film resource manager. “Someone with a background in accounting, education, or work experience could take this workshop and get trained to know what’s applicable in that field for working in the film industry.”

Membership data provided by IATSE 480 shows consistent growth as well. Membership has grown to approximately 1,800 members, with approximately 800 additional on their overflow list. They are currently adding roughly 30 additional people per month. In fiscal year 2023, nearly 82% of those crewing New Mexico film, television and digital media projects are New Mexico residents.

On Dec. 11, the New Mexico Economic Development Department appeared before the Legislative Finance Committee to present its upcoming budget request.

It includes funding for five full-time employees — two for the New Mexico Film Office and three for the New Mexico Media Arts Collective — at a recurring annual cost of $300,000.

Currently, the New Mexico Film Office has seven employees.

At the budget request meeting, Jon Clark, former state Economic Development acting secretary, said the budget request comes down to staffing.

“We have not had any additional staffing provided to the film division in years, and yet we’ve seen explosive growth in the industry,” Clark said. “Right now, we have zero (full-time employees) FTE dedicated to the media academy. We do need people and operational funds to get it up and going.”