- August 16, 2024

Manhattan Staging Comeback as Film and TV Office Leasing Increases

Facebook

Twitter

LinkedIn

Threads

Email

Latest Blogs

Related News

- June 12, 2025

From tentpole blockbusters to fast-turnaround streaming hits, the Universal Costume House remains one of the industry’s premier destinations for wardrobe and styling. With facilities in both Los Angel...

- June 12, 2025

Mark Duplass is done waiting for the streamers to come around. Instead, he’s building a new path—one project at a time.

As the traditional television ecosystem continues to contract and consolidate, ...

- June 11, 2025

At a time when U.S. production incentives remain fractured and fragile, Netflix’s Greg Peters is pointing across the Atlantic for inspiration.

Speaking at the Wall Street Journal’s CEO Council event ...

- June 10, 2025

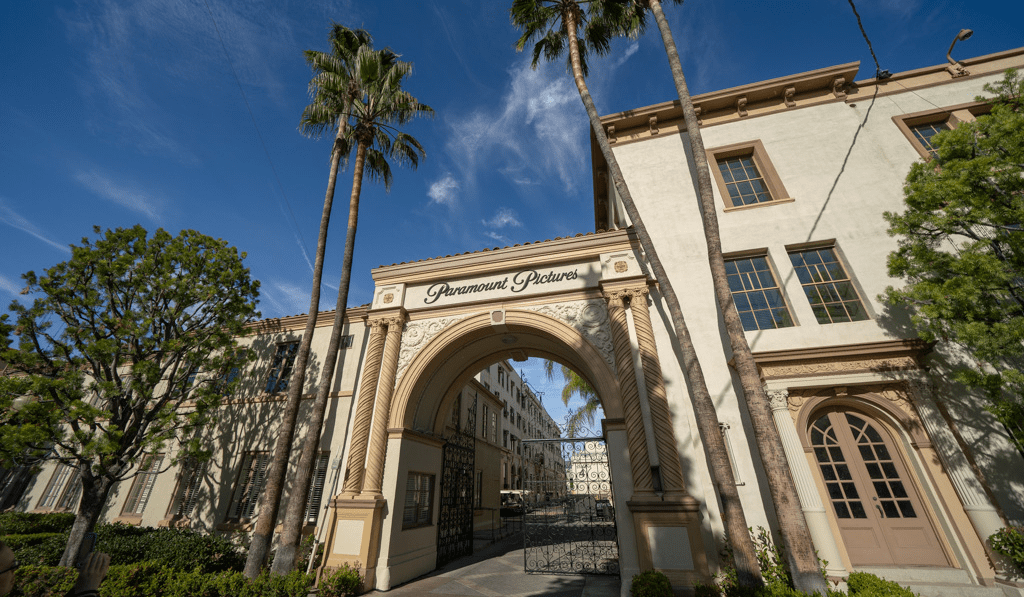

Paramount Global has initiated yet another round of layoffs, this time trimming 3.5% of its U.S. workforce—amounting to several hundred employees—as the legacy media giant continues to grapple with sh...

- June 9, 2025

Los Angeles doesn’t let go of its icons easily—but even soap operas need to pack up eventually. After 38 years and over 9,600 episodes at CBS’s Television City, The Bold and the Beautiful is officiall...

- June 9, 2025

Warner Bros. Discovery is splitting into two companies—one for streaming and studios, the other for global networks. It’s not just a reorg. It’s an admission: in this market, scale without focus is a ...

- June 9, 2025

In the escalating arms race for global production dollars, Mexico has the locations, the crews, the infrastructure — but it still lacks one key weapon: competitive incentives.

While international pro...

- June 6, 2025

In a key move to revive California’s flagging production economy, the State Senate on Tuesday passed a bill that would significantly expand eligibility and boost benefits under the state’s long-standi...

- June 6, 2025

As major studios continue to reconfigure their production pipelines and streaming platforms scale back in high-cost markets, Louisville, Kentucky, is quietly positioning itself as the next major playe...

- June 2, 2025

Western Australia is stepping up its game in the global production race. Starting July 1, Screenwest will double its post-production, digital, and visual effects rebate to 20%—now the most generous po...