- January 18, 2024

Global Production Alliance Wants Regulation Forcing U.S. Streaming Companies to Increase Local Content Spend

Facebook

Twitter

LinkedIn

Threads

Email

Latest Blogs

Related News

- June 2, 2025

Western Australia is stepping up its game in the global production race. Starting July 1, Screenwest will double its post-production, digital, and visual effects rebate to 20%—now the most generous po...

- June 2, 2025

Louisiana’s film industry just weathered a legislative rollercoaster — and may be stronger for it. In a dramatic turnaround, state lawmakers not only preserved Louisiana’s hallmark film tax incentive ...

- June 2, 2025

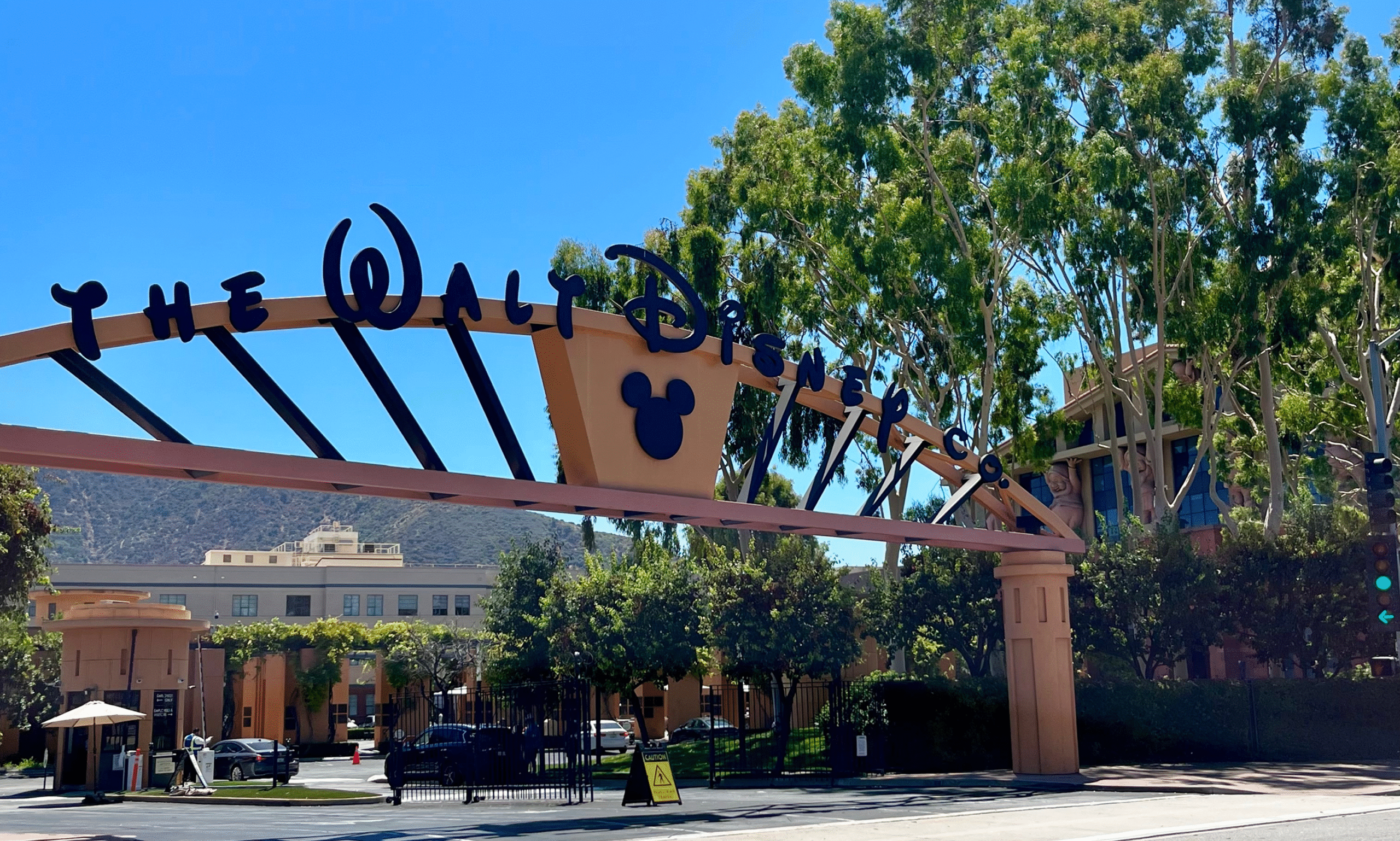

The Walt Disney Company began a sweeping round of layoffs Monday, impacting several hundred employees across its film, television, and corporate finance divisions. The cuts are part of a continued str...

- May 31, 2025

When Mountainhead premieres tonight on HBO and Max, it won’t just mark Jesse Armstrong’s return to HBO or his first feature film. It will stand as a blistering case study in rapid-fire production—conc...

- May 30, 2025

Fort Worth is officially getting in on the action. Hillwood, the Dallas-based real estate powerhouse behind AllianceTexas, is transforming more than 450,000 square feet of industrial space in the city...

- May 30, 2025

Inside Be Electric Studios' rise from a Brooklyn photo studio loft to 13 stages across NYC and a tri-state virtual production powerhouseWhile much of the film and TV industry is navigating a historic ...

- May 30, 2025

Rome’s legendary Cinecittà Studios is writing its next act—and this one’s built for global scale.

Under CEO Manuela Cacciamani, Cinecittà has unveiled a sweeping five-year industrial strategy that ai...

- May 28, 2025

Hollywood’s real estate giant is feeling the weight of an industry in flux.

S&P Global has downgraded Hudson Pacific Properties—parent company of Sunset Studios—to a speculative-grade “B” rating,...

- May 28, 2025

In a move aimed at reshaping the international studio landscape, Shadowbox Studios has announced a strategic partnership with Olivewood Studios, Jordan’s premier full-service film production facility....

- May 27, 2025

As Los Angeles navigates its post-strike rebound and the entertainment industry enters a new phase of hybrid production and AI integration, the future of studio infrastructure is up for debate—and red...