- December 19, 2023

Georgia Film Incentive Program Creates Fewer Jobs Than Industry Claims, Audit Finds

Facebook

Twitter

LinkedIn

Threads

Email

Latest Blogs

Related News

- May 22, 2025

As Los Angeles navigates its post-strike rebound and the entertainment industry enters a new phase of hybrid production and AI integration, the future of studio infrastructure is up for debate—and red...

- May 22, 2025

At the Cannes Film Festival this week, South Africa’s long-anticipated Cradle Film Studios took a major step forward, officially entering the financing stage after securing investment from the Industr...

- May 22, 2025

Zachary Levi, known for his roles in Chuck and Shazam!, has embarked on an ambitious venture with Wyldwood Studios, a creative hub situated near Austin, Texas. Established in 2020, Wyldwood is envisio...

- May 22, 2025

A groundbreaking digital replica of Auschwitz has been unveiled at the Cannes Film Festival, giving filmmakers an unprecedented new tool to accurately depict one of history’s most harrowing locations—...

- May 20, 2025

In a move aimed at fighting runaway production and reasserting Los Angeles as the capital of global filmmaking, Mayor Karen Bass has signed an executive directive to cut red tape and streamline city s...

- May 20, 2025

At today’s Google I/O conference, the company unveiled Flow, a new generative video tool designed for filmmakers, content creators, and visual storytellers. Powered by Google’s latest AI models, Veo 3...

- May 20, 2025

SP Media Group, the production and entertainment company led by veteran producer Paul Reitzin and advised by Jon Voight, has officially acquired Avenue Six Studios in Van Nuys, California—a strategic ...

- May 19, 2025

At a time when the race to attract international production has never been more competitive, Les Studios de Paris is thinking beyond soundstages—and positioning itself as a full-service command center...

- May 18, 2025

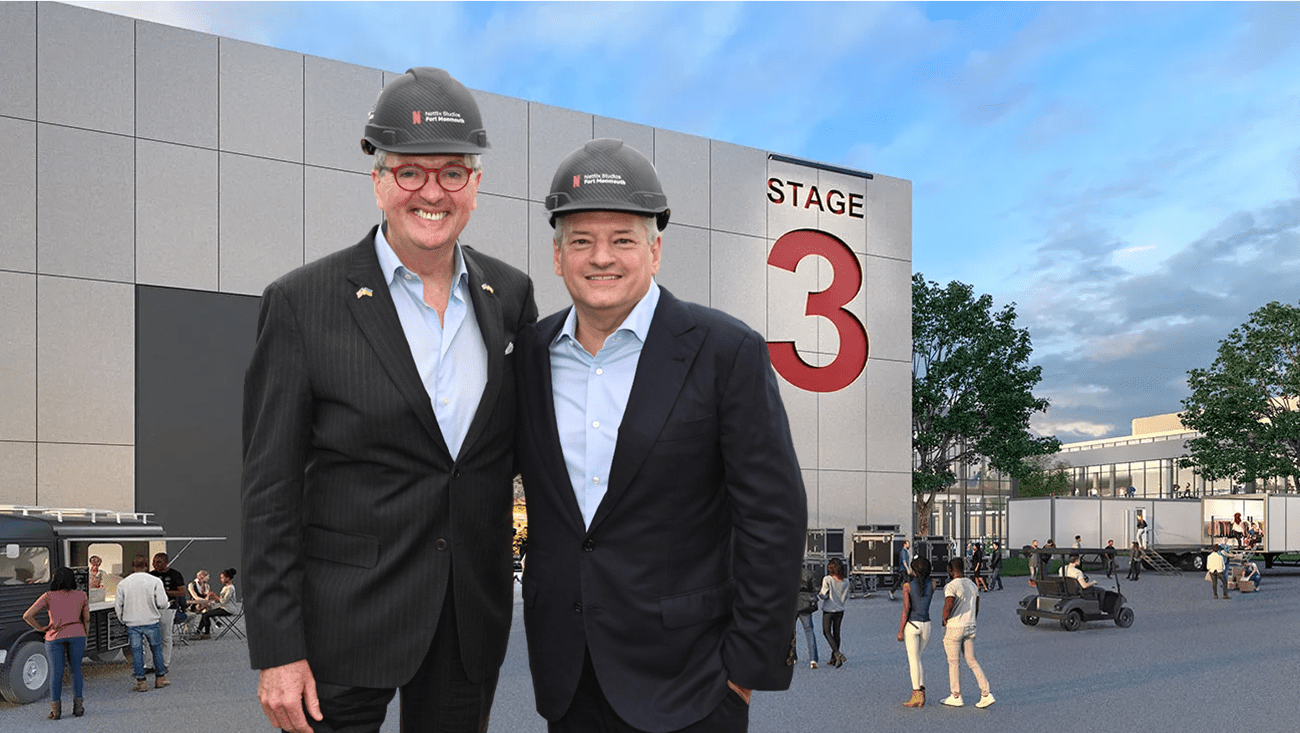

The sound of a wrecking ball smashing through a decommissioned military building in Eatontown, New Jersey, might not seem like a milestone moment in Hollywood history. But it is. Because with that sym...

- May 18, 2025

In an industry that thrives on momentum and reinvention, Saudi Arabia has emerged as one of global cinema's most unexpected success stories. It wasn't long ago—just six years, in fact—that the kingdom...