Hollywood’s production output continues to see significant contraction, with new data confirming a sharp drop in total TV episodes, hours, and series produced in 2023 and 2024. While streamers and studios recalibrate their content strategies post-Peak TV, theatrical releases have ticked upward, reflecting a shifting industry dynamic.

The Decline of TV Content

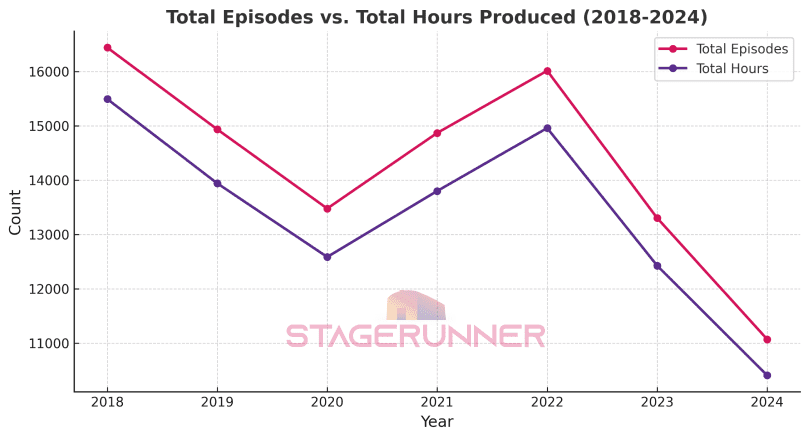

According to a new report from data provider Luminate, total TV episodes dropped from 16,012 in 2022 to 13,300 in 2023 and 11,069 in 2024, representing an 18% decline in just one year. Total hours of content followed the same trajectory, falling from 14,958 hours in 2022 to 10,405 in 2024, a striking 30% decline in two years. The data underscores the lingering effects of the 2023 writers’ and actors’ strikes, combined with strategic cutbacks from major streaming platforms.

Streaming services, once the engine of unprecedented content growth, are now significantly pulling back. Disney+, as previously signaled by CEO Bob Iger, saw its U.S.-produced premieres shrink dramatically from 25 in 2023 to just 9 in 2024. Max also experienced a contraction, falling from 44 premieres in 2023 to 32 in 2024. Hulu and Apple TV+ similarly cut back, reflecting the wider trend of platform consolidation and strategic cost-cutting.

However, Netflix remains the anomaly, increasing its U.S.-produced TV premieres from 140 in 2023 to 146 in 2024 and expanding its content spend from $17 billion to $18 billion this year. The streamer’s ability to weather the downturn contrasts sharply with competitors who are tightening their content budgets.

Theatrical Releases Rebound

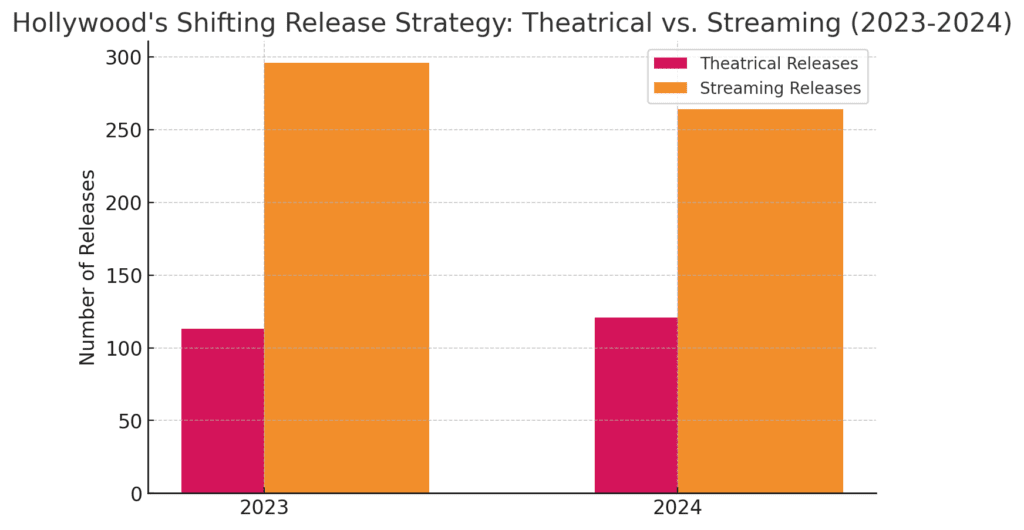

While TV output is shrinking, theatrical releases have seen a modest but notable recovery. The number of major studio films released in theaters increased from 113 in 2023 to 121 in 2024, signaling an industry shift back toward traditional box office strategies. This comes even as major tentpoles were pushed into 2025 due to last year’s production shutdowns.

The rise in theatrical releases aligns with the slowdown in direct-to-streaming films, which dropped from 296 in 2023 to 264 in 2024 as studios reassess their distribution models. With platforms emphasizing profitability over volume, streamers are relying more on licensed and theatrical content rather than flooding their platforms with originals.

The Industry at a Crossroads

The contraction in TV production and the stabilization of theatrical releases point to a transitional moment for Hollywood. Studios are no longer chasing streaming dominance through content oversupply but are instead focused on strategic investments and profitability. Meanwhile, Netflix’s ability to continue expanding its content slate underscores its dominant market position amid an industry-wide pullback.

As the data suggests, Hollywood is recalibrating—and where the industry lands in 2025 will depend on how well it balances cost-cutting, creative output, and consumer demand in an increasingly competitive landscape.