- October 21, 2024

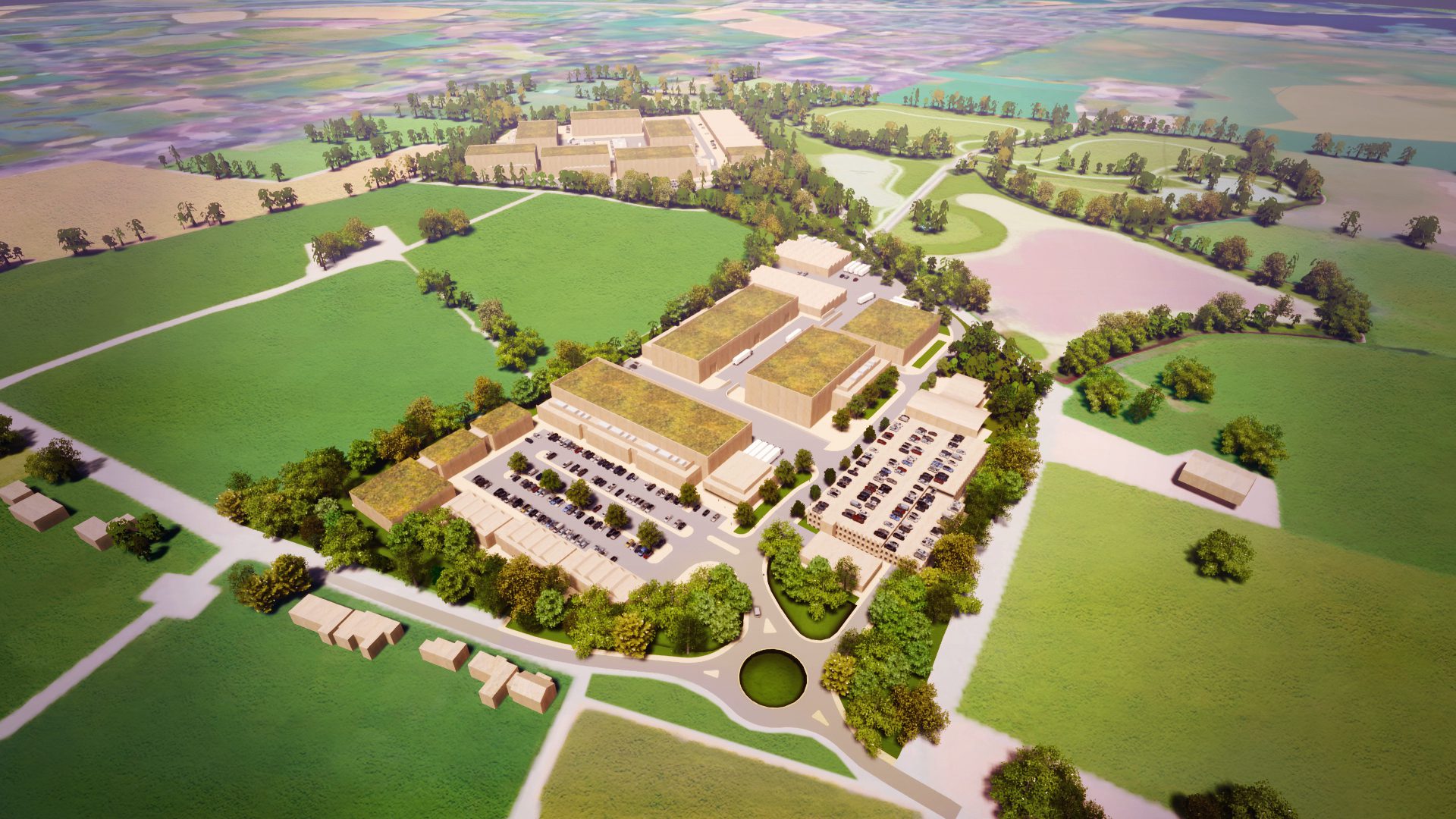

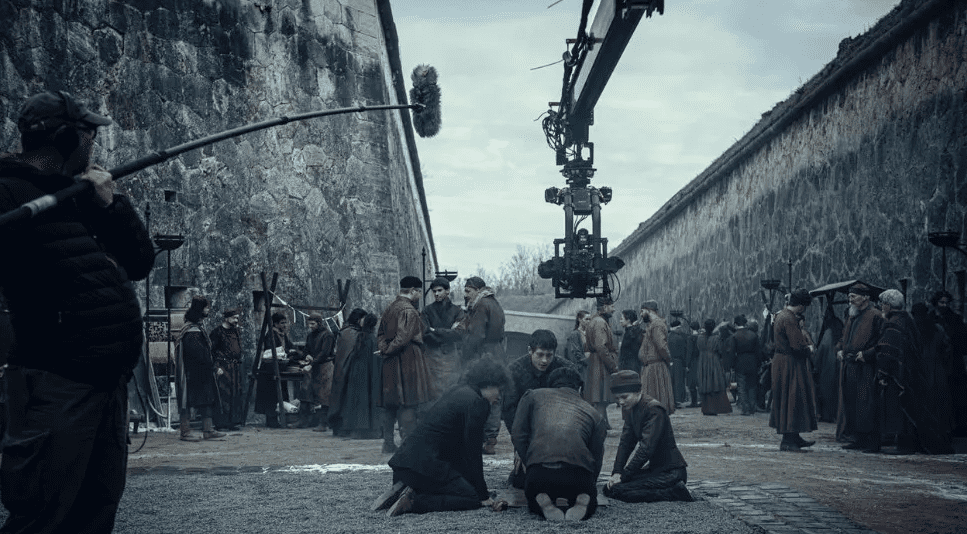

Prague Studios Expands to Meet Rising Demand for International Productions

Prague Studios is making a bold move to enhance its offerings with a major expansion project worth $10.8 million (CZK 250 million), aiming to transform an existing hall in the…