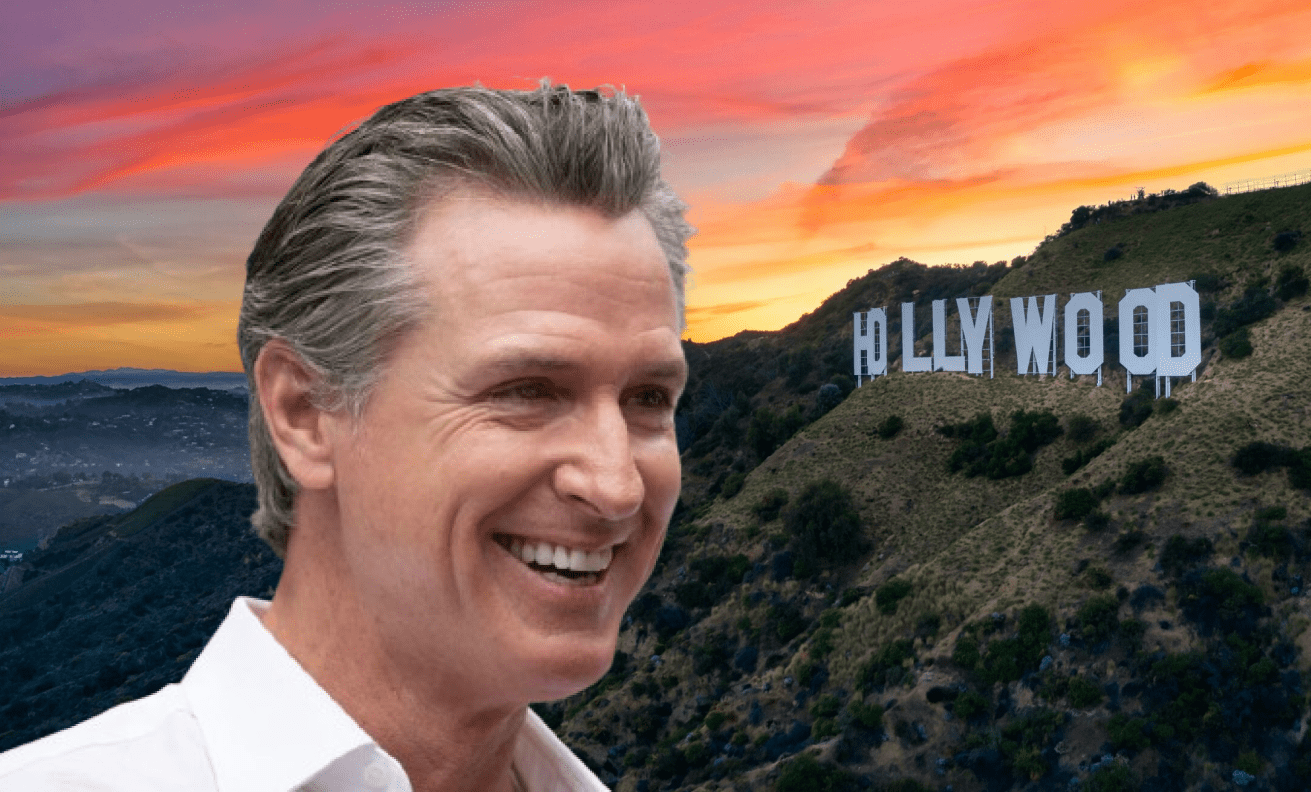

In a bold move to reinvigorate Hollywood, California Governor Gavin Newsom is set to announce a historic expansion of the state’s film and TV tax credits program, increasing the annual budget from $330 million to a staggering $750 million. This expansion, which doubles down on California’s commitment to keeping Hollywood competitive, aims to counter a recent downturn in local production, job opportunities, and economic output across the state. The announcement will take place at Raleigh Studios, one of Los Angeles’ iconic production locations.

Today’s announcement underscores a pivotal shift in California’s approach to supporting the industry. Governor Newsom, joined by L.A. Mayor Karen Bass and an assembly of labor leaders, film commissioners, and industry representatives, is placing the tax credit increase at the center of his 2025-2026 budget proposal. However, before this increase takes effect, it must pass through the state’s Democratic-majority legislature, a move designed to bolster industry confidence as California prepares for the next phase of its storied relationship with film and television.

With the industry facing fierce competition from production hubs across North America and Europe, Mayor Bass has been vocal about the urgent need to protect local jobs and provide the entertainment sector with a stronger foundation in California. “Our program needs to reflect the realities of today’s production landscape,” says one industry insider. “We’re seeing the demand for these incentives skyrocket, and productions are often bypassing California in favor of states like Georgia or nations like Canada, which offer more competitive rates and simpler application processes.”

Currently, California’s tax incentive program offers 20-25% in credits for studio films, independent films, new series, and relocating shows, but sources indicate that the demand far exceeds available funds. This shortage leaves many productions either out of the loop or forced to seek incentives in other regions. By more than doubling the allocated funds, Governor Newsom’s plan seeks to make the program accessible to a broader range of productions, positioning California to reclaim its place as a top destination for high-budget and prestige projects.

The California Film Commission, which oversees the incentives, will maintain its existing program framework, leaving current eligibility and credit rates intact but dramatically increasing funding to make these credits more available. “It’s not just about pouring more money into the pot,” says Newsom. “The goal is to provide our industry with the stability it needs to flourish and to keep productions—and jobs—here at home.” In a recent study by the Los Angeles Economic Development Corporation, every tax credit dollar spent generated $24.40 in economic output, reinforcing the benefits of keeping Hollywood production in-state.

Competing on a National and Global Stage

California’s new $750 million cap would make it the top capped tax incentive program in the U.S., surpassing New York’s $700 million, though it remains in fierce competition with states like Georgia, whose uncapped credit program offers a 30% incentive when productions feature the state logo. Georgia’s appeal has made it a go-to destination for big-budget series and features, with productions frequently noting the lower costs of operating in the state. Other states like New Jersey and Nevada have also increased their incentives, hoping to capture pieces of the booming film and TV market.

With the added investment, California hopes to pull projects back from these locations, while also competing with international powerhouses like Canada and European nations that offer similar financial advantages. In recent years, the state has seen a steady outflow of productions to more budget-friendly locales, putting California at risk of losing not only immediate job opportunities but long-term infrastructure and community investment.

In addition to supporting local employment, the program also addresses critical infrastructure needs, such as new soundstage construction projects in Los Angeles and across California. With significant investments planned in studio development, today’s announcement indicates that California is planning for sustainable, long-term growth in the entertainment sector, reinforcing its status as a creative and cultural capital.

Looking Ahead

For Hollywood, this is more than a tax incentive—it’s a commitment to growth, talent, and innovation. With the newly expanded program, Governor Newsom is betting on California’s competitive edge in an industry that increasingly depends on smart, scalable support for both productions and local economies. As the new phase of California’s tax credits rolls out, producers, soundstage operators, and studios across the country and the world will be watching closely to see how the Golden State navigates this ambitious new chapter.