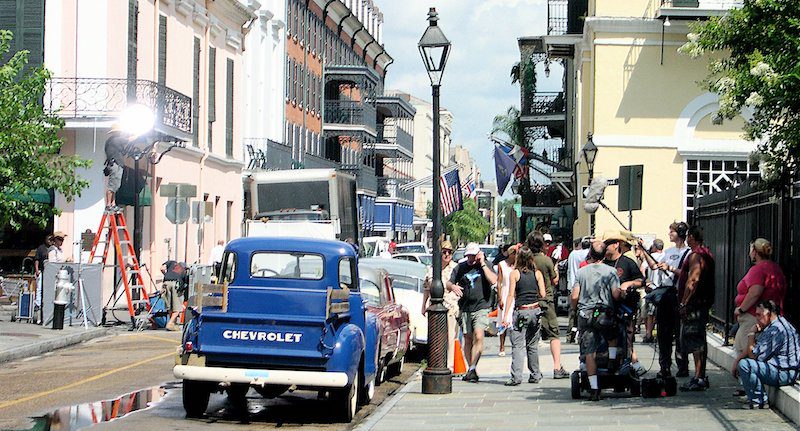

When a $215 million film comes knocking on your door, it is probably best to answer.

Arizona did just that when Disney’s big-budget film adaption of “The Lone Ranger” set its sights on Tucson when searching for locations to shoot this spring, according to Shelli Hall of the Tucson Film Office.

Unfortunately for Arizona, one issue prevented that door from opening: tax incentives.

“They were here for about eight days in a row, which is a huge commitment on Disney’s part: scouting locations with us and looking at all sorts of landscapes in southern Arizona,” Hall said. “We knew our (film tax) incentive program had ended, but we were trying to see if there’s something we could do on a state level to incentivize them to come here.”

“The Lone Ranger” instead went to Albuquerque Studios in New Mexico due to the state’s competitive film tax incentive program. New Mexico is just one of 41 states that currently offers tax credits to film productions.

Arizona began its tax incentive program in 2006, but it expired in 2010 without renewal. The film tax bill (also known as House Bill 2127) is currently back in the House for a second time this year after passing both the House and Senate in recent months.

State’s film history

Ever since 1926, Tucson has had an active presence in the film industry. The Old Tucson Studios were originally constructed in 1934 for the feature film “Arizona,” and the surrounding area attracted dozens of Westerns starring the likes of John Wayne and Paul Newman.

The filmmaking trend continued across the state into the modern age of cinema, where recent movies such as “The Kingdom,” “Take Me Home Tonight” and “Everything Must Go” have all used Arizona as their backdrop. In light of the tax incentive’s expiration, no major film projects have shot in the state, which has delivered a major blow to the economy.

“The lack of the tax incentive has really affected us when it comes to the large budget projects that are looking for those types of incentives,” film commissioner for the Phoenix Film Office Philip Bradstock said. “Our labor pool of skilled, technical artists has kind of seen the need to leave because of no major projects coming in.”

The primary purpose of the tax incentive program is to give filmmakers and production studios tax credits for investing money in the state’s economy through their projects. Eligible productions must spend at least $250,000 in the state, which may include expenses such as hotel rooms, restaurants and rental car services.

One of the most recent major productions was “Piranha 3D,” which shot in Lake Havasu City in 2009 and generated $18 million in revenue for the city’s economy, according to the president of the Lake Havasu Chamber of Commerce Lisa Krueger.

“It was at a time in this economy — let’s just say it couldn’t have come at a better time,” Krueger said. “One of the reasons they came to Arizona to film, besides obviously, the location in Havasu was perfect for the storyline, was because of the tax incentive that was available to them.”

“Piranha 3D” was one of the last major feature films to shoot in Arizona before the incentive program expired. Now, many films that may have originally considered Arizona often turn to New Mexico. Major movies such as “The Avengers” and television series like “Breaking Bad” have filmed there, which has been a huge boost for the state’s economy.

Film incentives help state’s economy

Filmmaker Brent Morris, who recently co-directed a documentary about the New Mexico film industry called “Made In New Mexico,” says tax credits are one of the most important factors that come into play when deciding where to shoot.

“Tax incentives are one of the key pieces of financing that producers look for now,” Morris said. “One of the only ways now that most states can bring more production to their state is because of these tax credits. It’s not just money that the state is giving to Hollywood, it’s going through the entire economy.”

In 2008, the Arizona film industry was responsible for more than 12,000 jobs in the state and generated $1.5 billion for local businesses and industries, according to the 2010 Economic and Fiscal Impact Analysis of Proposed Motion Picture Tax Credit.

The analysis also notes that the average annual wage for someone in the Arizona film industry is more than $52,000, which is higher than the state’s average occupational wage of roughly $39,000.

Mike Kucharo, president of the Arizona Film and Media Coalition, believes that the state has lost several hundred million potential dollars since the tax incentive program was shut down. He admits that past versions of the bill may not have been perfect, but thinks that the latest draft is “fiscally responsible” and will provide long-term benefits for the state as a whole.

“I’ve heard people say, ‘Well, it gives money to film producers who don’t need it’ and all that, but it’s not about giving money to anybody,” Kucharo said. “It’s about incentivizing people to come here to work and to hire local people to use Arizona goods and services and leave the money here. It’s not about subsidizing anyone, it’s about bringing money here that doesn’t exist.”

Arizona tourism is just one industry that would benefit from the free advertising that occurs when people see the state on their televisions or when they go to the movies, Kucharo says.

The temperate climate year-round is also a major draw to Arizona. Coastal states like Louisiana have tax credit programs, but are forced to shut down film production two to three months a year due to the lack of hurricane insurance, Hall said. Arizona is ideal for filming both indoors and outdoors throughout the year and the unique landscape allows it to represent exotic environments such as the Middle East, Mexico and Vietnam.

She also notes that Arizona is in close proximity to both Los Angeles and Burbank, which is particularly attractive for members of the film industry based in Hollywood.

Aside from the many geographical benefits, Kucharo thinks the bill is fair to all parties and promotes competition.

“HB 2127 levels the playing field,” Kucharo said. “It gives the industry the chance to compete against other states, because without it, there’s nothing we can do.”

Steve Voeller, president of the Arizona Free Enterprise Club, does not believe a competitive atmosphere should be encouraged.

“If you get into that race, that’s a race you can’t win,” Voeller said. “The people in the movie industry, if they really are picking and choosing where to go based on the size of the tax credit, that’s just a game we shouldn’t be in.”

Some against state’s film tax credits

The Arizona Free Enterprise Club has actively lobbied against the bill because the organization itself is strongly against tax credits. Voeller believes such incentives tax some people in order to give benefits to a targeted group of people and ultimately drain the state of its funds.

Reports from the Arizona Department of Commerce show that over the course of three years the incentives were active, the state spent more than $14 million in tax credits but only made back $4 million of that, according to Voeller. To him, the number of jobs and the money itself does not justify the tax credits based on past experience.

“At what point are lawmakers going to say, ‘Well I’m sorry, we did movies, we did solar energy, we picked industry X, Y, Z, but we can’t pick you,’” Voeller said. “I don’t think most taxpayers in the state, whether you’re Republican, Democrat or Independent, want their lawmakers deciding who gets the goodies and who gets the short end of the stick. It’s not meant to be carved up like this.”

The Goldwater Institute is another major organization that is opposed to the film tax incentives. Senior economist for the Institute Stephen Slivinksi thinks that it allows the government to give special treatment of the tax code to particular businesses, but ultimately sacrifices other necessary government functions.

“By definition, you have to keep taxes higher on other people to generate the same kind of revenue you would have if you had taxed everyone equally,” Slivinksi said. “It becomes a much bigger question — not just about film tax credits, but a bigger question about these types of incentives that are being provided by state and local governments and whether they actually inhibit fair interstate competition.”

Hall believes that many of the people who oppose the bill simply do not understand it in its entirety or have been misinformed by what others say about it.

“Tax incentives are complicated and they are hard to understand,” Hall said. “I think there’s misinformation going around at the Legislature that some people are maybe even propagating because they’re against tax incentives in general.”

Kucharo also thinks that many people merely oppose the philosophy of tax credit itself, but do not realize it may be a necessary measure in getting Arizona’s economy back on its feet.

“I would like to see lower taxes, I would like to see no taxes, I would like to do all kinds of things, but the reality is the world isn’t that way and other people are taking work away from us,” Kucharo said. “That just has to stop.”

Building a steady work force is one reason why supporters of the tax incentive have been careful to include a specific section of the revised bill that would give a television series production priority placement over other productions that may not have yet received approval, according to the Senate Amendments to HB 2127.

A television series would guarantee between six to nine months of work per season and would create a continuous supply of local jobs according to Ruben Angelo, a local producer who founded Rangelo Productions and is involved with various television projects.

“It’s recurring revenue — not only for the state, but for the actors and filmmakers,” Angelo said. “Not only that, but each episode you can bring in new crew and new directors, and give new people opportunities to pay their bills and earn a living.”

This would require private sectors to begin building soundstages, which have been largely absent across the state. One of the most notable soundstages was Carefree Studios in Scottsdale where “The New Dick Van Dyke Show” was filmed but was eventually torn down in the late 1990s, according to the Phoenix Business Journal.

With an influx of television productions and a steadier stream of movies being produced, workers would be able to stay in Arizona with their families rather than being forced to relocate to other states to work, according to Bradstock.

If the bill does not pass this year, Bradstock worries for the future of the tax incentive bill along with the Arizona film industry on a whole.

“I’m very concerned that if this doesn’t pass this time, all of those people are going to uproot their families and move out of here because they’re going to want to be where their work is,” Bradstock said.

“I think they’ve all been holding out trying to make this happen, but if we get rejected this time, it’s really hard to justify to remain here in Arizona.”