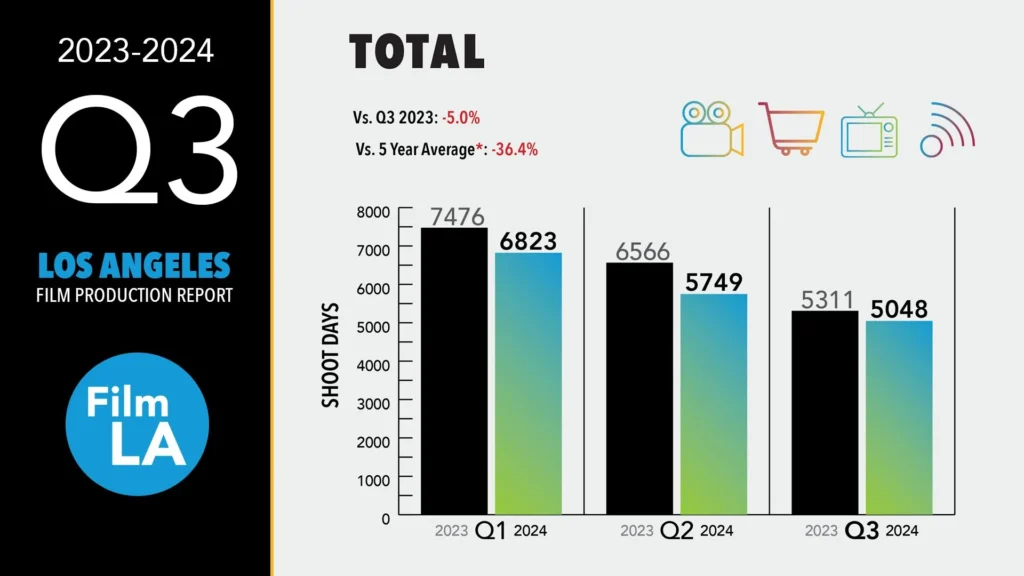

Hollywood continues to face significant production challenges, as reflected in the latest FilmLA report for Q3 2024. Shoot days in Los Angeles fell by 5% compared to the same period last year, marking the second-slowest summer on record, even below the strike-hit Q3 2023. Despite hopes for a recovery, the industry’s output remains well below expectations, particularly in the key areas of scripted television and reality TV.

A total of 5,048 shoot days were logged from July to September, making this quarter the weakest of the year. The report underscores that Los Angeles production still hasn’t regained the momentum lost after the pandemic-era streaming boom, with every category of scripted production trailing behind adjusted five-year averages.

Scripted television continues to struggle, with 758 shoot days recorded for TV dramas, comedies, and pilots during Q3. This sector, a vital driver of local production activity, remains well below historical norms as demand for content shifts and production schedules remain unpredictable. Reality TV, once a reliable source of production activity, saw a staggering 56.3% decline, with just 946 shoot days—a drop steep enough to account for the bulk of the overall loss across all categories.

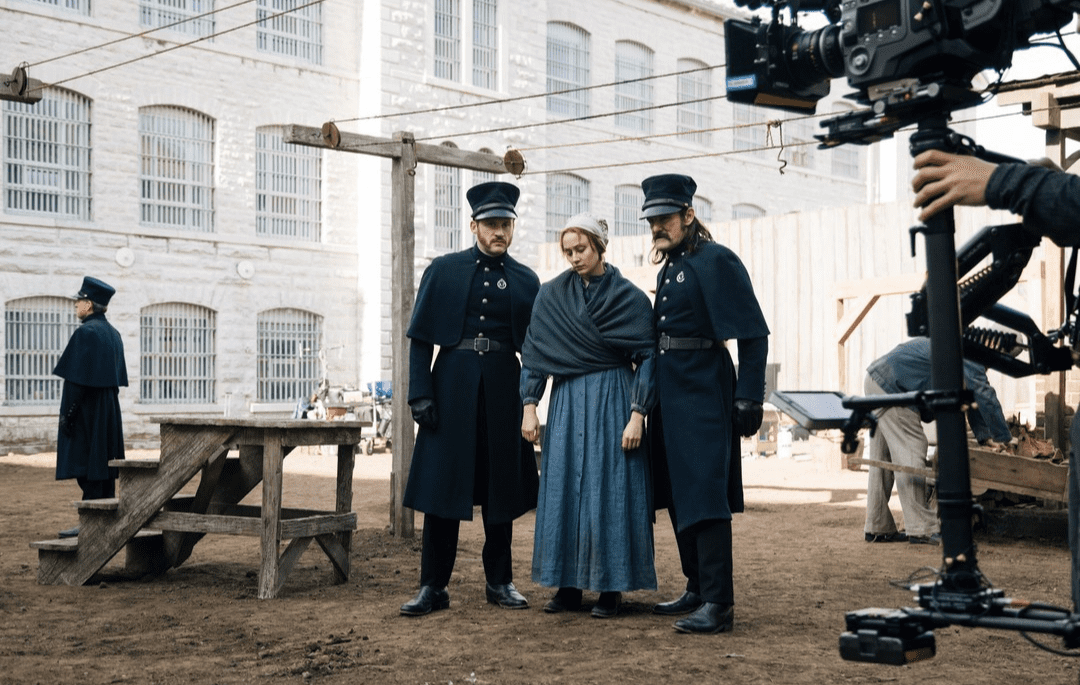

However, there is a bright spot in feature film production. While other sectors have slowed, feature films saw a 26.6% increase in shoot days, logging 476 days in Q3. This surge offers hope that LA’s film industry could be finding some stability in larger productions. This growth is attributed in part to the California Film & Television Tax Credit Program, which has played a significant role in drawing feature films back to Los Angeles. High-profile productions like Forever, Matlock, and Orphan—along with veteran series like S.W.A.T. and The Rookie—took advantage of these tax incentives, accounting for nearly 25% of TV drama shoot days.

While feature films may be leading the recovery, other sectors, such as commercial production, are also showing promise. Commercials recorded 814 shoot days, a 7.4% increase compared to the same period last year. This marks the first year-over-year growth in commercial production since 2022, with major brands like Amazon, Microsoft, and Starbucks choosing Los Angeles for their campaigns.

The California Film & Television Tax Credit Program remains critical to supporting local production, but the need for adjustments is becoming clear. As competitors like Georgia and the UK continue to innovate and attract productions with their own incentives, California must evolve to stay competitive. The current program has proven successful in creating jobs and driving economic activity, but more funding and updated eligibility criteria are needed to reflect the realities of the industry in 2024.

As we head into Q4, there is cautious optimism for a more balanced recovery. The improvement in feature films and commercials offers hope, but the industry will need continued support and innovation to fully recover from the challenges of recent years.

Read FilmLA Report by clicking HERE