- April 22, 2025

Will a 35% Tax Credit Be Enough to Keep Hollywood in Hollywood?

Facebook

Twitter

LinkedIn

Threads

Email

Latest Blogs

Related News

- May 13, 2025

Rams owner and billionaire developer Stan Kroenke is placing a high-stakes bet on the future of production in Los Angeles with the announcement of Hollywood Park Studios — a major new soundstage and o...

- May 13, 2025

The Royal Film Commission of Jordan has unveiled a revamped and competitive cash rebate program, positioning the Kingdom as one of the most attractive filming destinations in the Middle East—and perha...

- May 13, 2025

After a near miss that left the Louisiana film industry holding its collective breath, the state’s film tax credit program has officially survived. The incentive that helped birth hits like Sinners, C...

- May 12, 2025

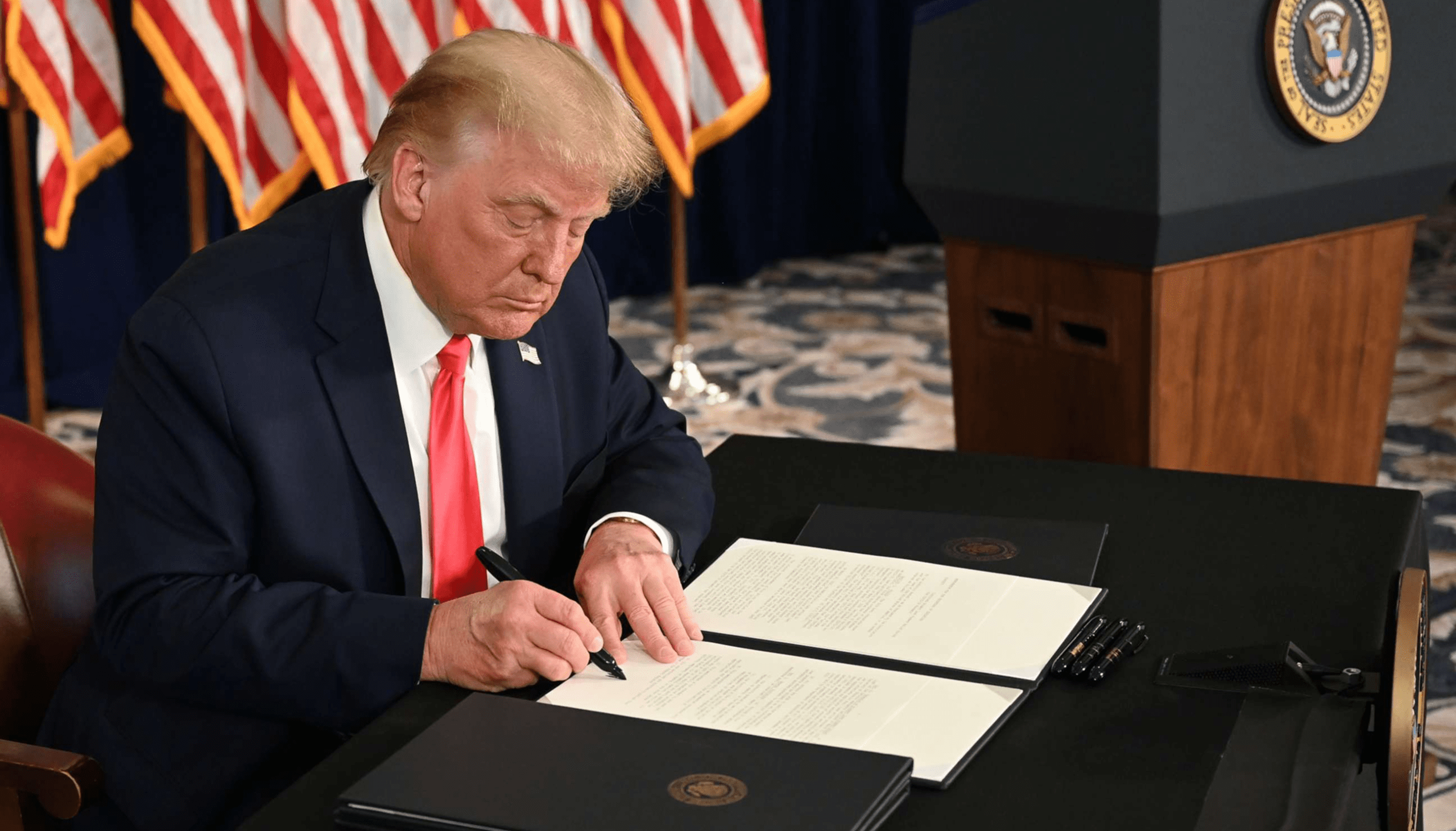

In a rare bipartisan moment in Hollywood, a coalition of studio executives, top guild leaders, and actor-turned-political envoy Jon Voight have joined forces to ask President Trump for expanded federa...

- May 12, 2025

Netflix is officially going Jersey. The streaming giant will break ground this week on a $903 million production complex at Fort Monmouth—a sprawling 289-acre former Army base on the Jersey Shore—as i...

- May 11, 2025

As Trump teases new tariffs aimed at punishing studios for filming overseas, California is quietly trying to win back Hollywood’s business the old-fashioned way: with a boatload of cash.

Governor Gav...

- May 10, 2025

Hollywood power players aren’t waiting for the next Trump tweet to figure out what comes next. On Friday, studio execs from the likes of Netflix, Disney, Amazon, and Warner Bros. quietly dialed in to ...

- May 9, 2025

The Aussie film industry has a message for Mel Gibson: Call your friend Trump and tell him to cool it with the movie tariffs. After Donald Trump’s May 4 announcement of a 100% tariff on all films prod...

- May 9, 2025

It’s official: New York State has supercharged its production incentives. With Gov. Kathy Hochul signing the delayed state budget into law, producers can now count on a significantly sweeter deal to s...

- May 7, 2025

PIXOMONDO (PXO), the award-winning virtual production and VFX powerhouse behind House of the Dragon, The Boys, and Star Trek: Strange New Worlds, has officially launched its newest LED Volume in Vanco...