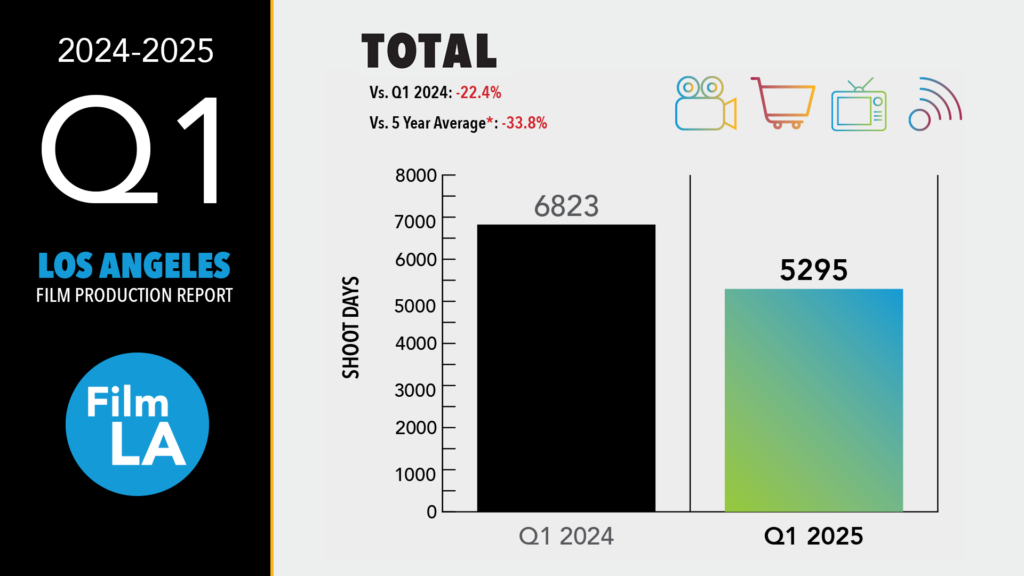

Los Angeles, once the unrivaled capital of film and television production, is feeling the chill of a global production downturn. According to FilmLA’s newly released Q1 2025 report, the city saw just 5,295 shoot days across all categories from January to March—a 22.4% drop from the same period last year.

TV, historically L.A.’s bread and butter, took the hardest hit. The region posted only 1,670 shoot days for scripted and unscripted television—down 30.5% from Q1 2024. Pilots, a key seasonal driver for crew employment and soundstage occupancy, reached their lowest level since tracking began, with just 13 pilot shoot days reported.

“This is the smallest number of TV pilots we’ve ever seen,” said FilmLA’s VP of Communications Philip Sokoloski. “It’s a reflection of a marketplace that hasn’t bounced back the way many hoped it would after the strikes.”

The chart above underscores the year-over-year collapse across major TV genres:

•TV Drama: -39%

•TV Comedy: -30%

• TV Reality: -27%

•TV Pilots: -80%

Soundstage occupancy tells a similar story. FilmLA’s recent analysis of 17 major stage operators revealed a 63% average occupancy rate in 2024—down from 69% in 2023, and far below pre-pandemic highs.

Meanwhile, lawmakers are scrambling to modernize California’s film and TV tax credit program. A new proposal would broaden eligibility to include sitcoms, animation, and large-scale competition shows. Productions must meet a $1 million budget minimum, and the expanded program could offer up to 35% in credits for projects shot in Los Angeles County.

But in the face of international competition and reduced studio spending, the stakes remain high.

“The jobs are going elsewhere—New Jersey, Georgia, even international territories,” said Joan Allen, a location manager who’s worked in L.A. for over 20 years. “Without faster legislative action and a creative rethink of how we support this ecosystem, we’re going to lose more than just pilot season. We’re going to lose the center of gravity.”

Despite recent wildfires in Pacific Palisades and Altadena displacing some shoots, FilmLA noted that these events had a minimal effect on the overall production decline, accounting for only 1.3% of local shoot days over the past four years.

As Hollywood recalibrates after strikes and budget pullbacks, L.A.’s once-unstoppable production engine is idling. Whether 2025 becomes a year of creative recovery or continued contraction may rest on the industry’s ability to adapt—fast.